We Understand That

Navigating the complexities of licensing and permitting is essential for any business to operate legally and efficiently. At ARC Tax, we provide expert guidance to ensure you secure the necessary licenses and permits for your business, no matter your industry. From business license applications to industry-specific permits, we streamline the process so you can focus on growing your business.

Our services include assistance with alcohol and tobacco licenses, sales tax permits, zoning and occupancy approvals, and more. Proper licensing not only ensures compliance with federal, state, and local regulations but also builds trust with customers and establishes your business as a credible and professional operation.

Let ARC Tax handle the paperwork and intricacies of licensing and permitting, giving you peace of mind and more time to focus on what

Licensing and Permitting Services

Business License Applications

Every business, no matter the size or industry, requires a proper license to operate legally. Filing for a business license ensures compliance with state and local laws, establishes your business’s credibility, and allows you to focus on growth with peace of mind. By handling the application process efficiently, you can avoid delays and launch your business with confidence.

Formation and EIN

Embarking on a new business venture? Let us streamline the paperwork process for you. No matter the structure (LLC, corporation, partnership, etc.) we can provide the proper paperwork for your entity and obtain your Employer Identification Number (EIN). Our experts provide personalized guidance to get your business built on a solid foundation.

Registered Agent

Whether a small startup or a large corporation, utilizing a registered agent service is a strategic decision that can facilitate smoother operations, enhance privacy, and ensure compliance with state laws and regulations, ultimately contributing to your business's overall success and longevity.

Zoning and Occupancy Permits

Whether you're opening a new business or relocating an existing one, obtaining zoning and occupancy permits is essential to ensuring your business operates within local regulations. These permits verify that your location is properly zoned for your business type and that the space meets safety and accessibility standards. Securing these permits not only ensures compliance but also sets the foundation for your business to operate without disruptions.

Business Plans

A well-crafted business plan is your roadmap to success. Our team specializes in creating detailed, strategic business plans that not only help in securing funding but also guide your business decisions, setting you on a path to achieving your goals.

Professional Licenses

From contractors to cosmetologists, obtaining a professional license is a key step in legally practicing your trade. It establishes credibility, ensures compliance with industry standards, and provides customers with confidence in your services. A streamlined licensing process allows you to focus on delivering excellence in your field

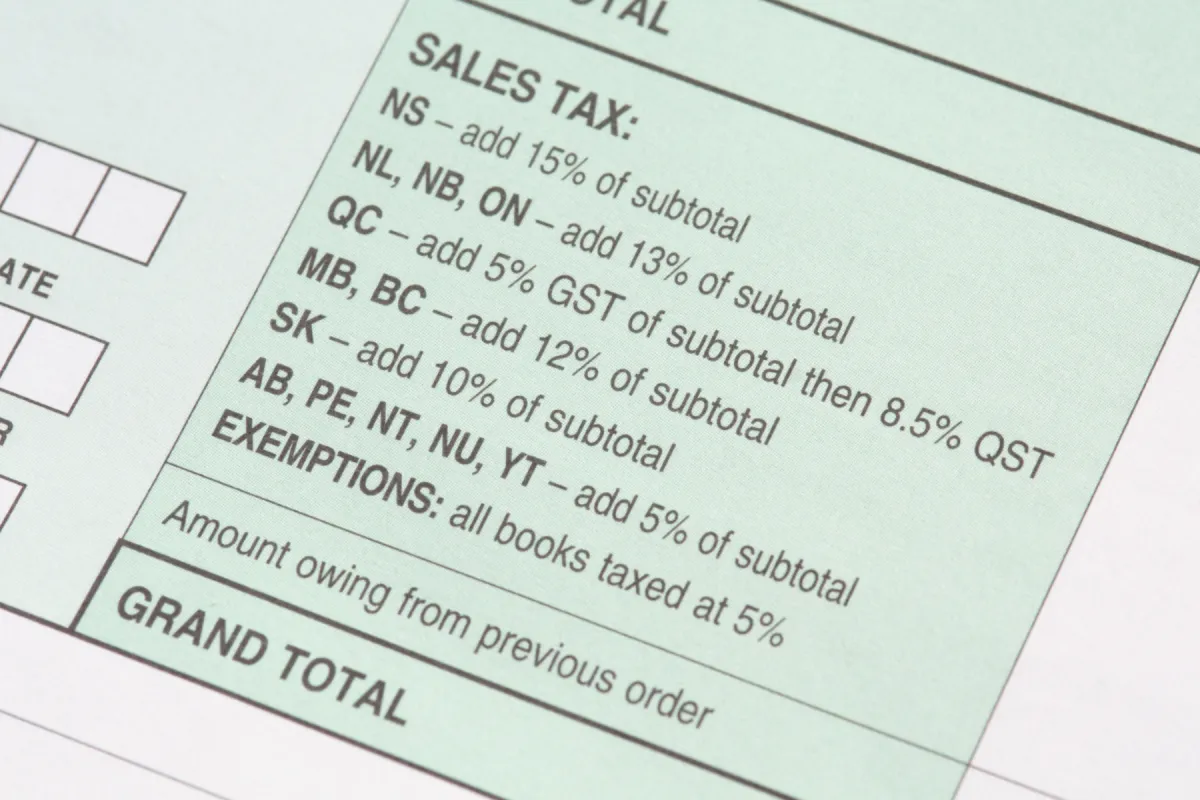

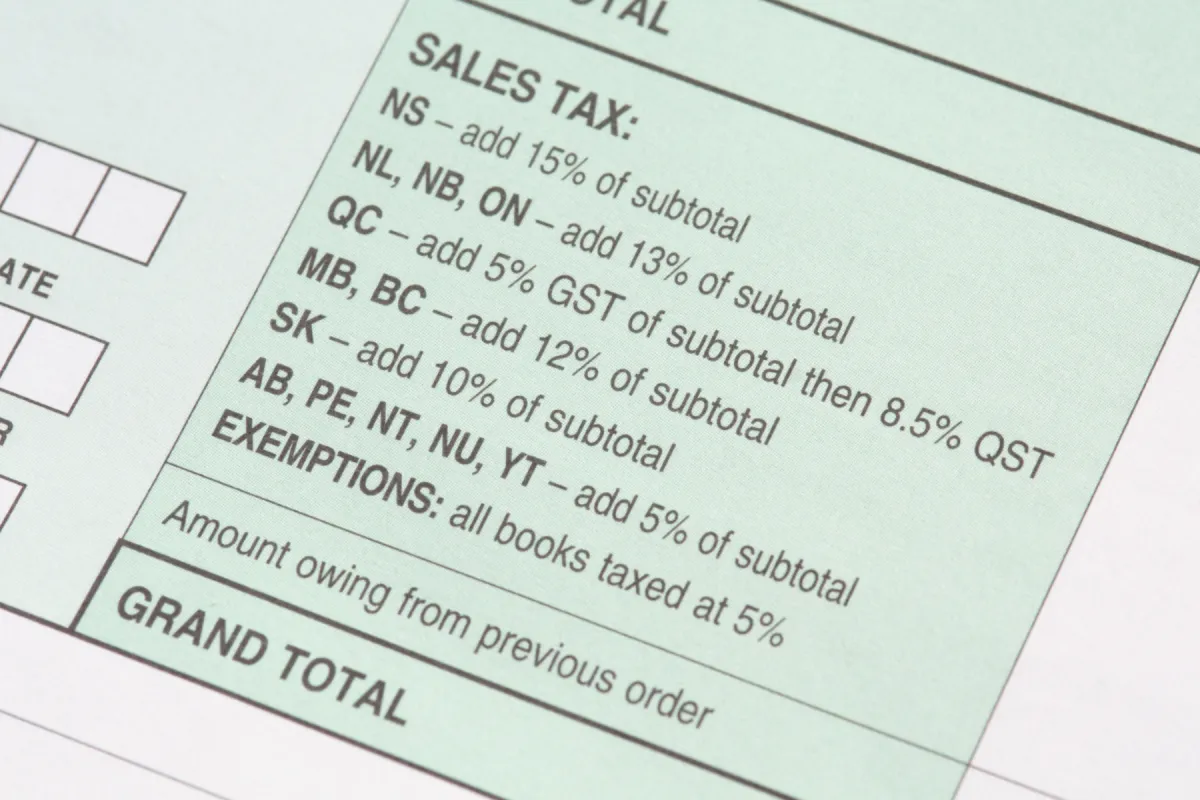

Sales Tax Licenses

Whether you run a small business or a growing enterprise, a sales tax license is vital for legally collecting and remitting sales tax. It ensures compliance with state tax laws and allows your business to operate seamlessly while building trust with customers. Proper registration eliminates potential fines and paves the way for long-term success.

Alcohol Licenses

Whether you're opening a bar, restaurant, or retail store, obtaining the proper alcohol license is a critical step in your business journey. Securing this license ensures compliance with state and local regulations, protects your business from legal issues, and allows you to serve or sell alcohol responsibly. With expert guidance, you can streamline the application process and focus on building a thriving establishment.

Tobacco Licenses

For businesses planning to sell tobacco products, obtaining a tobacco license is essential. This step not only ensures compliance with federal, state, and local laws but also helps build consumer trust by demonstrating your commitment to operating responsibly. A well-managed licensing process sets the foundation for your business to grow without unnecessary delays or penalties.

Licensing and Permitting Services

Business License Applications

Every business, no matter the size or industry, requires a proper license to operate legally. Filing for a business license ensures compliance with state and local laws, establishes your business’s credibility, and allows you to focus on growth with peace of mind. By handling the application process efficiently, you can avoid delays and launch your business with confidence.

Formation and EIN

Embarking on a new business venture? Let us streamline the paperwork process for you. No matter the structure (LLC, corporation, partnership, etc.) we can provide the proper paperwork for your entity and obtain your Employer Identification Number (EIN). Our experts provide personalized guidance to get your business built on a solid foundation.

Registered Agent

Whether a small startup or a large corporation, utilizing a registered agent service is a strategic decision that can facilitate smoother operations, enhance privacy, and ensure compliance with state laws and regulations, ultimately contributing to your business's overall success and longevity.

Zoning and Occupancy Permits

Whether you're opening a new business or relocating an existing one, obtaining zoning and occupancy permits is essential to ensuring your business operates within local regulations. These permits verify that your location is properly zoned for your business type and that the space meets safety and accessibility standards. Securing these permits not only ensures compliance but also sets the foundation for your business to operate without disruptions.

Business Plans

A well-crafted business plan is your roadmap to success. Our team specializes in creating detailed, strategic business plans that not only help in securing funding but also guide your business decisions, setting you on a path to achieving your goals.

Professional Licenses

From contractors to cosmetologists, obtaining a professional license is a key step in legally practicing your trade. It establishes credibility, ensures compliance with industry standards, and provides customers with confidence in your services. A streamlined licensing process allows you to focus on delivering excellence in your field

Sales Tax Licenses

Whether you run a small business or a growing enterprise, a sales tax license is vital for legally collecting and remitting sales tax. It ensures compliance with state tax laws and allows your business to operate seamlessly while building trust with customers. Proper registration eliminates potential fines and paves the way for long-term success.

Alcohol Licenses

Whether you're opening a bar, restaurant, or retail store, obtaining the proper alcohol license is a critical step in your business journey. Securing this license ensures compliance with state and local regulations, protects your business from legal issues, and allows you to serve or sell alcohol responsibly. With expert guidance, you can streamline the application process and focus on building a thriving establishment.

Tobacco Licenses

For businesses planning to sell tobacco products, obtaining a tobacco license is essential. This step not only ensures compliance with federal, state, and local laws but also helps build consumer trust by demonstrating your commitment to operating responsibly. A well-managed licensing process sets the foundation for your business to grow without unnecessary delays or penalties.

FAQS

Does the type of business entity I choose affect my taxes?

Yes, the business entity you select—such as an LLC, corporation, sole proprietorship, or partnership—directly impacts how your business income is taxed. For example, LLCs and partnerships are pass-through entities, meaning the income is taxed on your personal return, while corporations pay taxes at the corporate level.

What is the difference between a sole proprietorship and an LLC for tax purposes?

A sole proprietorship reports all business income on the owner’s personal tax return using Schedule C. An LLC can choose to be taxed as a sole proprietorship, partnership, or corporation, offering more flexibility and potential liability protection.

Will forming a business reduce my taxes?

It depends. Forming a business entity can help you access deductions and tax-saving strategies unavailable to individuals. For instance, LLCs and corporations can deduct business expenses such as salaries, equipment, and operational costs. The exact benefits depend on your business structure and income.

Do I need a separate tax ID (EIN) for my business?

Yes, most business entities require an Employer Identification Number (EIN) for tax filing and compliance purposes. Sole proprietors with no employees can use their Social Security Number, but an EIN is often recommended for added privacy and professionalism.

How do I determine which expenses are tax-deductible for my business?

Tax-deductible expenses include costs that are ordinary and necessary for running your business, such as rent, utilities, advertising, and payroll. The specific deductions you qualify for depend on your business structure and operations.

What are quarterly estimated tax payments, and does my business need to make them?

Quarterly estimated tax payments are required if your business is expected to owe $1,000 or more in taxes at year-end. This applies to pass-through entities (e.g., sole proprietorships, partnerships, and LLCs) and some corporations. These payments help you stay compliant and avoid penalties.

How does payroll impact my business taxes?

If your business has employees, you’re responsible for withholding and paying payroll taxes, such as Social Security, Medicare, and unemployment taxes. These must be reported and paid on time to avoid penalties.

Can I change my business entity if my tax needs evolve?

Yes, you can change your business structure as your business grows or your tax needs change. For example, a sole proprietorship can transition to an LLC or corporation for liability protection or tax benefits. This process often involves filing new paperwork with the IRS and your state.

How do I file taxes if my business operates in multiple states?

If your business operates in multiple states, you may need to file state taxes in each jurisdiction where you conduct business. This often includes income tax and, in some cases, sales tax or franchise tax. Understanding nexus rules is critical to ensure compliance.

Turn Your Network into Your

Net Worth

Share ARC Tax services and earn cash rewards for every successful referral. Start earning today!

Become An Agent

Want to earn additional income, working on your terms? You can partner too! Let's grow together!

See why we're trusted

Hours

Mon – Fri 9:00am – 5:00pm

Saturday – Appt only

Sunday – CLOSED

Location

3293 Stone Mountain Hwy

Ste G-116

Snellville, GA 30078

Phone

678-921-5278